|

Hey there, rockstar doula! We know you're all about supporting moms during their magical journey into motherhood, but have you ever taken a moment to dive into the dollars and cents of your doula business? Don't worry; we've got your back. In this blog post, we're going to break down the financial components that'll help you navigate the business side of being a doula with flair and finesse. It's time to get sassy with your finances – let's roll! The Doula Business: Where Passion Meets Profit Your doula gig is a one-of-a-kind adventure, and it's not just about the joy of supporting moms-to-be – it's also about being the boss of your own doula empire. Whether you're a seasoned badass doula or just starting out, understanding the financial side is crucial to keep your doula business thriving. Cha-Ching: Income Streams for Doulas Okay, let's talk about the moolah – your income! Most of your doula dollars will come from the amazing services you provide to your clients. Prenatal care, labor and birth support, postpartum TLC – it all adds up. Your fees may vary based on where you're located, how experienced you are, and what services you offer. So, make sure to set crystal-clear prices that let potential clients know exactly what they're getting while making sure you are not undervaluing yourself and making enough to support your lifestyle. But wait, there's more! Some doulas kick it up a notch and diversify their income streams. Think childbirth education classes, workshops, or even selling cool doula-related products. These side gigs can be a financial game-changer for your doula empire. If you are looking for income stream ideas and ways to level up to that 6-figure income be sure to check out our value packed free webinar. Crunching the Numbers: Understanding Expense Running your doula biz means dealing with expenses. There's no avoiding it, but you've got this! Here are some of the things you might need to budget for:

Show Me the Money: Calculating Profitability Now, let's get down to business – calculating your profitability. It's like your financial report card. To figure it out, just subtract your total expenses from your total income. A positive number means your doula business is making a profit – you go, girl! A negative number means you're running at a loss, but don't worry, every financial guru started somewhere.

Financial Planning for Your Doula Future Let's talk future, darling! Your doula empire deserves a bright and prosperous tomorrow. Here's how you can make it happen:

You're the CEO of Your Doula Dollars In the grand scheme of your doula journey, mastering the financial side is like getting a backstage pass to your own success show. Your financial health is a reflection of your business acumen and a solid foundation for making a profound impact in the lives of your clients. So, own those doula dollars, boss babe, and let your financial savvy shine through as you continue rocking your doula empire with passion and power!

0 Comments

Many birth businesses struggle with understanding the ins and outs of finances in their practice, and often don’t know if they’ve made any money until the end of the year. Sometimes, they discover they haven’t actually made any money once they account for their expenses. The good news is, it is not too late to learn how to always have a profitable business. The majority of birth businesses fail because of poor cash flow management or burnout (but that’s a whole different blog). That’s a stressful environment to be in, but it doesn’t have to be. Here at BABES, one of our core missions is to help you create sustainable business practices. A great tool to implement in your birth business today is called The Profit First strategy. It comes from the best selling book, Profit First by Mike Michalowicz, which teaches business owners how to “transform any business from a cash-eating monster to a money-making machine.” This article will provide a summary of The Profit First strategy to help you:

Traditional Profit Calculations According to business literature including my own business degree education, profits are what is left over after subtracting business expenses from your income (revenue). Sales – Expenses = Profit While it is true that this is a formula for calculating profits, it is not a method that guarantees you will have a positive number for your profit. Profit First Formula The Profit First formula flips the equation, doing exactly what the name entails putting the focus on profits before expenses. Sales – Profit = Expenses You might be thinking how this really makes a difference, but what Michalowicz is trying to highlight is more psychological than anything: you have to approach your business thinking profit first, not profit last. The Profit First Strategy The premise of the strategy is to build a system for your business that is sustainable and creates long term success. The first thing is to account for your business profit, your taxes, and your own pay. What is left over is what you have to spend on everything else. Many people approach expenses (marketing, website, rent) as just part of the business. They often think of it in terms of things that can be avoided, delayed, eliminated, or just plain unavoidable. This strategy teaches you to discipline yourself and your business finances so they are broken down into categories with only a set amount allotted for expenses. This way you force yourself to spend wisely and really focus on expenses that are most important. For those of you already in business this can be a radical change from how you have been doing things. You might have to hold off on some purchases in the short run in order to set yourself for long term success. This approach gives you the opportunity to grow your income and profits, so you will have the resources to invest back into your business without creating that same situation that causes most businesses to fail. If you put everything you have back into your business you risk not being able to sustain your business the way you want to or worse not being able to sustain your business at all. How to Start Your Profit First Strategy in 5 easy Steps 1. Get your Accounts in Order The first step is to break down how your bank account works. This means creating multiple smaller accounts within your existing bank account. If you don’t already have a sperate business bank account you will want to get one. This will require an EIN (Employee Identification Number) and your business registration. You want to have 5 different accounts that are based on your core business functions:

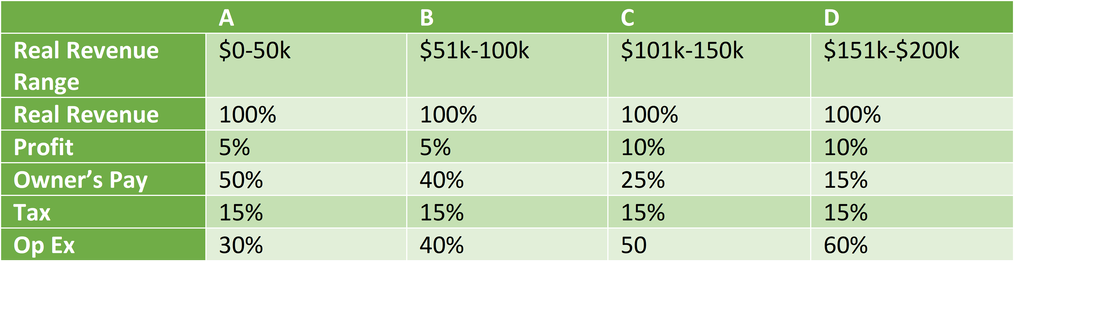

When opening bank accounts for your Profit First business, you should open three checking accounts for Income, Owners Compensation, and Operating Expenses. Two saving accounts for Profit and Tax. 2. Profit First CAPS & TAPS After creating your separate accounts you will have to decide two different percentages. Current Allocation Percentages (CAPS) and the Target Allocation Percentages (TAPS). You will use these percentages to determine how to distribute your income into the different accounts. Proceeds from sales should be deposited into your main Income account then distributed into your other accounts based on the percentages you’ve allotted for each destination. CAPS This is where your business is at right now. What does your income and expenses look like day-to-day in its current format. TAPS This is where you want your business to be; these are the ideal percentages you’re working towards hitting. The goal is to gradually move from your CAPS to your TAPS. This is not an overnight kind of deal. It may take months or even a year, but that is why it is a process. You can’t work towards your goals until you know what they are and know where you are starting from. If the suggested 5% profit is too much then bump it down to 1% to start with. 1% is still a profitable business. The following table is an example of different revenue-dependent scenarios. 3.Transfer Funds

When you get income it should go directly into your main account. Select a time that works with your business on when to distribute funds. How often this happens is completely up to you, though it is recommended to distribute on the 10th and 25th of each month. Some businesses do this process weekly or bi-weekly. 4.Make Payments Use your separate accounts for their intended purpose. Avoid moving funds around in the accounts to meet expense needs.

As Michalowicz says in his book, “Owner’s compensation is the money you get paid for working in your business; profit is the reward you get for owning it.” 5.Review At the end of each quarter, review your process and how it is working in your business. Adjust as needed. It is as simple as that. Change your mindset, change your life (and business). We teach this strategy and so many other topics to ensure sustainability in your birth business in our BABES Business Academy. |

Details

Archives

May 2024

Categories

All

|

RSS Feed

RSS Feed